This course is designed to introduce students to commercial loan transactions. The course starts by defining commercial finance in general and identifying the purpose of loan transactions. It then describes the common types of loans and identifies the components of a commercial loan transaction. Subsequently, the course identifies the key documents in a commercial loan transaction and describes the role of commitment letters and term sheets. Finally, the course identifies the essential roles transactional attorneys play in commercial finance transactions.

Overview of Commercial Loan Transactions

Training courses associates and partners love and law firms need.

Upon completion of this course, participants will be able to:

- What is commercial finance?

- What do we mean by commercial finance?

- Why is commercial finance important for businesses?

- Commercial finance key terms

- Common types of loans

- Term loans

- Revolving lines of credit

- Project loans

- Real estate loans

- Components of a commercial loan transaction

- Determining the type of loan

- Structuring the transaction

- Drafting the loan documentation

- Closing and refinancing of existing indebtedness

- Key documents in a commercial loan transaction

- Role of commitment letter/term sheet

- Purpose of a commitment letter and term sheet

- Interest rates

- Floors and caps on variable loan rates

- Commitment/origination fees & other out-of-pocket expenses

- Roles of transactional attorneys in commercial loan transactions

Supplemental Materials/Additional Resources:

- Sample term sheet

- Sample commitment letter

- Sample credit agreement

- Sample note

- Sample guaranty

Class Content Overview

Course Details

Instructors Who Practice What They Teach

Our vetted instructors are global practitioners with outstanding professional and educational qualifications and demonstrated achievement in their fields. All have 10+ years Big Law experience.

In addition to their accomplishments as practitioners, our instructors are also passionate about teaching. We carefully interview instructor candidates to assess personality, domain expertise and effectiveness in the classroom. Our instructors must maintain a 4.5 out of 5 rating from students.

Frequently Asked Questions:

What are the best training programs for law firm associates?

The best training programs for law firm associates combine essential legal knowledge with practical skill development. AltaClaro offers comprehensive training solutions that encompass various topics crucial for associates' success, ensuring they are well-equipped for their roles in a fast-paced legal environment.

How can legal departments enhance training for summer interns?

To enhance training for summer interns, legal departments can implement structured programs that include mentorship, workshops, and hands-on projects. AltaClaro's training modules can serve as an excellent foundation, providing interns with practical skills they can apply during their internship and beyond.

What innovative legal training solutions are available for law firms?

For law firms looking to innovate their training approaches, AltaClaro offers a range of cutting-edge solutions. Our platform features custom training programs, on-demand resources, and analytics tools that empower firms to deliver relevant and effective legal training.

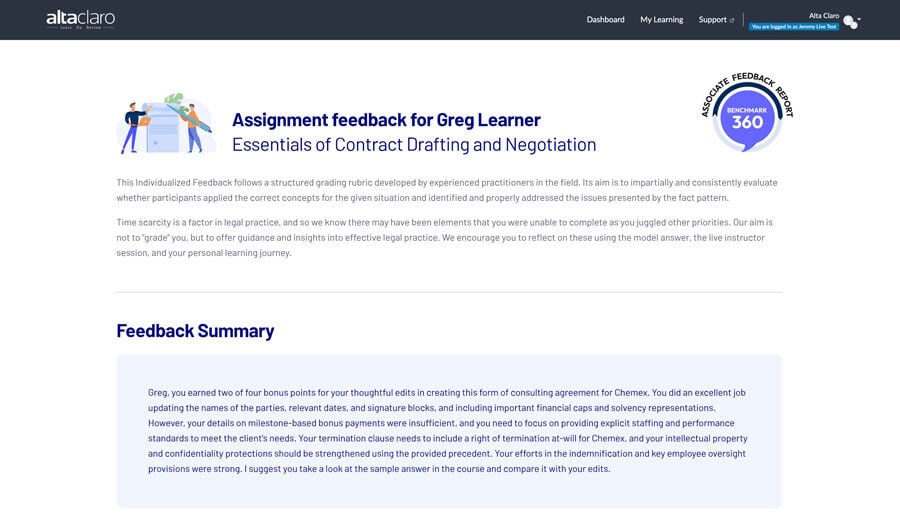

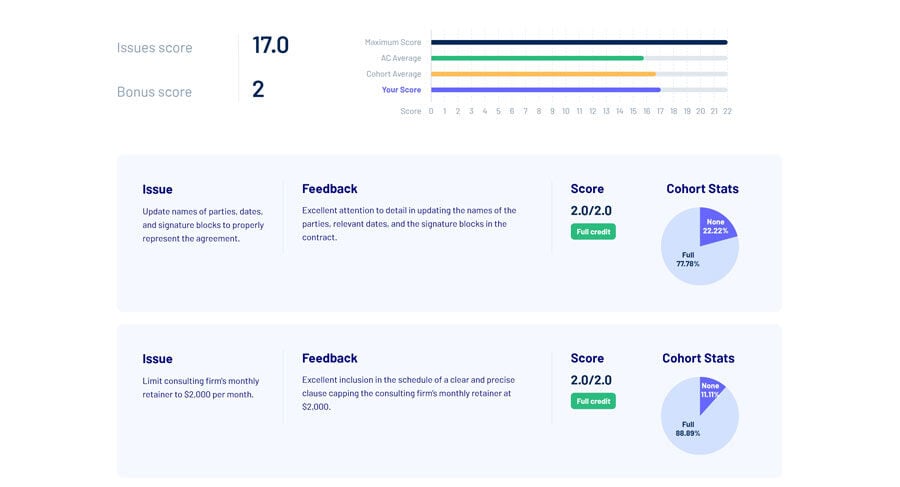

Are there experiential learning courses for law professionals?

Yes, we provide experiential learning courses tailored for law professionals. Our training platform emphasizes real-world scenarios that allow participants to apply their knowledge in a practical setting, making the learning experience both engaging and relevant.

What online training options improve practical skills for lawyers?

At AltaClaro, we offer a variety of online training options designed to enhance practical skills for lawyers. From our immersive practice-driven training modules to interactive courses focusing on key areas like negotiation and litigation, there's something for everyone looking to advance their career.