Managing the Closing Process in Commercial Loan Transactions

Training courses associates and partners love and law firms need.

Upon completion of this course, participants will be able to:

- Identify the typical stages of a lending transaction and how those stages vary depending upon the parties to and type of lending transaction.

- Describe the topics of due diligence and the process for conducting due diligence in a typical lending transaction, including how to order and review lien search reports.

- Articulate the typical closing obligations and responsibilities of the various parties and recognize the types of ancillary documents typically required in lending transactions.

- Understand the role of a junior attorney in a lending transaction, specifically the responsibilities of a junior associate in the closing and post-closing stages.

- Complete a closing checklist.

Class Content Overview

Course Details

Students are presented with a banking client that has approved a borrower for a proposed credit facility consisting of a term loan and a revolving loan facility. Students are asked to prepare a closing checklist for the new deal, based on the term sheet and sample checklist provided.

Instructors Who Practice What They Teach

Our vetted instructors are global practitioners with outstanding professional and educational qualifications and demonstrated achievement in their fields. All have 10+ years Big Law experience.

In addition to their accomplishments as practitioners, our instructors are also passionate about teaching. We carefully interview instructor candidates to assess personality, domain expertise and effectiveness in the classroom. Our instructors must maintain a 4.5 out of 5 rating from students.

Frequently Asked Questions:

What are the best training programs for law firm associates?

The best training programs for law firm associates combine essential legal knowledge with practical skill development. AltaClaro offers comprehensive training solutions that encompass various topics crucial for associates' success, ensuring they are well-equipped for their roles in a fast-paced legal environment.

How can legal departments enhance training for summer interns?

To enhance training for summer interns, legal departments can implement structured programs that include mentorship, workshops, and hands-on projects. AltaClaro's training modules can serve as an excellent foundation, providing interns with practical skills they can apply during their internship and beyond.

What innovative legal training solutions are available for law firms?

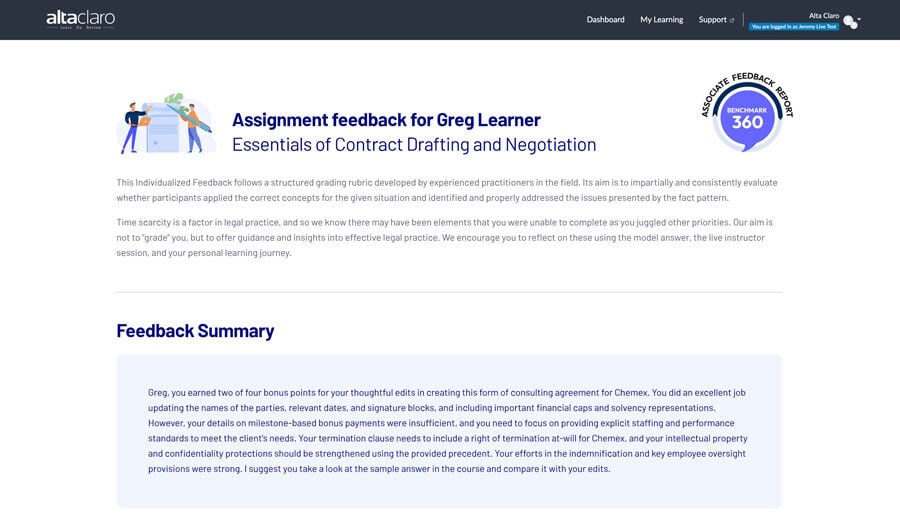

For law firms looking to innovate their training approaches, AltaClaro offers a range of cutting-edge solutions. Our platform features custom training programs, on-demand resources, and analytics tools that empower firms to deliver relevant and effective legal training.

Are there experiential learning courses for law professionals?

Yes, we provide experiential learning courses tailored for law professionals. Our training platform emphasizes real-world scenarios that allow participants to apply their knowledge in a practical setting, making the learning experience both engaging and relevant.

What online training options improve practical skills for lawyers?

At AltaClaro, we offer a variety of online training options designed to enhance practical skills for lawyers. From our immersive practice-driven training modules to interactive courses focusing on key areas like negotiation and litigation, there's something for everyone looking to advance their career.