This class is designed to provide a deeper understanding of the overall securities transaction process and legal framework focusing on offerings under Regulation D, with a secondary focus on private placements generally. The class starts by providing an overview of the key legal considerations, statutory provisions, and fundamental documentation that are involved in a Regulation D offering, and then leads participants through advising a client looking to raise equity capital through a Regulation D offering with an emphasis on learning how to identify relevant considerations, legal issues and documentation. Particular focus will be given to the junior associate and in-house counsel role in the process.

IPO Due Diligence

Training courses associates and partners love and law firms need.

- Understand the essential legal and regulatory framework applicable to Regulation D offerings

- Be familiar with Regulation D exemptions and essential deal documents

- Be able to contribute meaningfully in the deal process

- Draft and negotiate basic terms of a stock purchase agreement

Class Content Overview

Level: Basic

Course Details

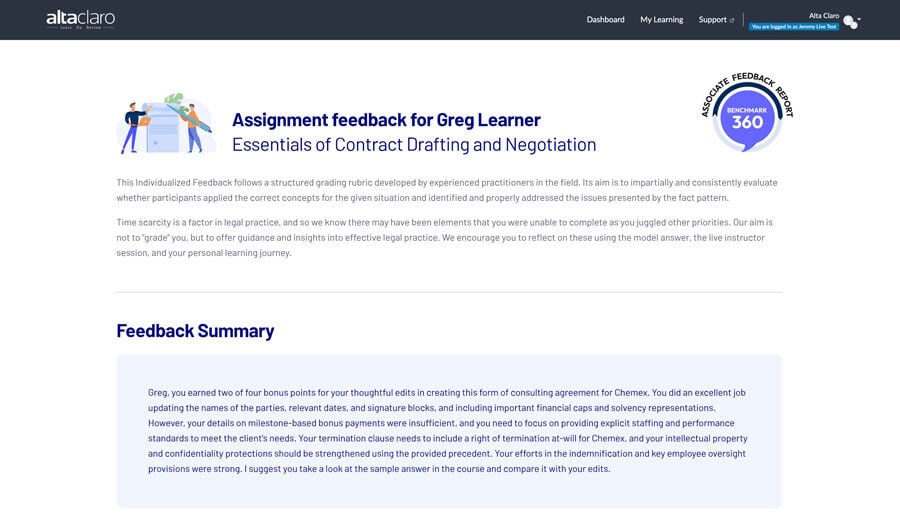

Participants will be provided with an example of a purchase agreement for a Regulation D offering and will be asked to tailor it to the specific hypothetical issuer. Participants will assume the role of a junior associate in preparing the purchase agreement, taking into account the various considerations discussed in presentation materials.

Instructors Who Practice What They Teach

Our vetted instructors are global practitioners with outstanding professional and educational qualifications and demonstrated achievement in their fields. All have 10+ years Big Law experience.

In addition to their accomplishments as practitioners, our instructors are also passionate about teaching. We carefully interview instructor candidates to assess personality, domain expertise and effectiveness in the classroom. Our instructors must maintain a 4.5 out of 5 rating from students.

Frequently Asked Questions:

What are the best training programs for law firm associates?

The best training programs for law firm associates combine essential legal knowledge with practical skill development. AltaClaro offers comprehensive training solutions that encompass various topics crucial for associates' success, ensuring they are well-equipped for their roles in a fast-paced legal environment.

How can legal departments enhance training for summer interns?

To enhance training for summer interns, legal departments can implement structured programs that include mentorship, workshops, and hands-on projects. AltaClaro's training modules can serve as an excellent foundation, providing interns with practical skills they can apply during their internship and beyond.

What innovative legal training solutions are available for law firms?

For law firms looking to innovate their training approaches, AltaClaro offers a range of cutting-edge solutions. Our platform features custom training programs, on-demand resources, and analytics tools that empower firms to deliver relevant and effective legal training.

Are there experiential learning courses for law professionals?

Yes, we provide experiential learning courses tailored for law professionals. Our training platform emphasizes real-world scenarios that allow participants to apply their knowledge in a practical setting, making the learning experience both engaging and relevant.

What online training options improve practical skills for lawyers?

At AltaClaro, we offer a variety of online training options designed to enhance practical skills for lawyers. From our immersive practice-driven training modules to interactive courses focusing on key areas like negotiation and litigation, there's something for everyone looking to advance their career.